25+ what's a second mortgage

Web Second mortgages which are legal are taken out in addition to primary mortgages and are commonly used to access a homeowners home equity. Web A second mortgage may also make sense if youre overwhelmed with high interest debt and a home equity loan will enable you to reduce your monthly payments and interest costs to a manageable level.

25th May Build Upon Presentation

What Are the Alternatives to Silent Second Mortgages.

. For instance if you normally qualify for a 525 mortgage rate expect a 575625 rate for a second home. Web A second mortgage is commonly referred to as a home equity line of credit HELOC or a home equity loan. Closing costs can cost 3-6 of the loan amount.

The year-over-year increase in net loss was primarily due to a 59. Web A second mortgage is a loan that lets you cash out the available equity in your home. Web You apply for a second mortgage.

A second mortgage is when you sacrifice your own home equity by turning it into a loan in exchange for a faster way to pay off other debts complete home improvement projects or buy something you couldnt otherwise afford. Web Heres a quick look at the 2023 NCAA Tournament second-round games on today Saturday March 18 with TV channels start times and more information about college basketballs March Madness. Web A second mortgage means youll make two house payments.

Web What is a second mortgage. Mortgage lenders will likely add 50100 basis points to whatever the ongoing rate is. 31 2022 increased to 394 million as compared to 39 million for the year ended Dec.

A lien is a right to possess and seize property under specific circumstances. What Homeowners Need to Know About Second Mortgages. Similar to the mortgage on your primary.

Web What Is A Second Mortgage. Your DTI ratio is calculated by dividing your total monthly debt including both mortgage payments by your gross income. Web If you have a home worth 300000 and 200000 remaining on your mortgage for instance you might be able to borrow as much as 55000 through a second mortgage.

Of course this strategy will only work if you can avoid running up additional debt like the ones that got you in trouble to begin with. Web A silent second mortgage is a loan to help cover the costs of acquiring a primary mortgage for a home such as a down payment. A second mortgage is secured by your home which means you can lose your home if you dont repay.

Web A second mortgage is a loan that uses your home as collateral similar to the loan you used to purchase your home. Web Also called an 80-10-10 loan it allows borrowers to avoid paying mortgage insurance by combining a second mortgage for 10 of the homes cost with a primary mortgage for 80 of the homes cost. Significant fees may apply.

Web Your biggest expense will be your mortgage. Web Your second home has to be used as a residence in order to qualify for a second home mortgage it cant be an investment or rental property. In this case its 275000.

A second mortgage is a lien taken out against a property that already has a home loan on it. Web By starting with the current value of your home you can determine how much money you can borrow in a second mortgage. Web Impac Mortgage Holdings reported a second straight year of losses.

Using a second mortgage to tap equity wont impact your existing home loan. Web A second mortgage is a loan in addition to your first mortgage thats still ongoing using your home as collateral. There are both legal and illegal types of silent second mortgages borrowers should be aware of.

Web The second mortgage is a lump sum payment made out to the borrower at the beginning of the loan. A second mortgage is another loan taken against a property that is already mortgaged. Second mortgage lenders usually require a debt-to-income DTI ratio of no more than 43 although some lenders may stretch the maximum to 50.

Definition and Examples of a Silent Second Mortgage. Web Second mortgages are typically used for home improvements or paying off large debts. Web A second mortgage is a type of home loanlike a home equity loana lender approves in addition to an original mortgage that has not yet been paid off.

You must pay it back. These options may be a more streamlined approach for obtaining the funds you need for things that suddenly come up like the dream house you just saw in that primo neighborhood. Impac reported the net loss for the year ended Dec.

The loan requires a separate application and has a new interest rate amount and monthly payment. Using a second mortgage homeowners. Often 85 although some lenders allow more.

The amount you can get for a second mortgage is based on your homes equity. The current market value of your home minus anything owed is your home equity. The most common examples of second mortgages are home equity loans and home equity lines of credit HELOCs.

If for example your home is worth 300000 and a mortgage lender lets. Second homes have other costs you should consider such as. Earnings were down for the fourth quarter as well.

Speciality insurance policies and riders. Second mortgages are often used for items such as home improvement or debt consolidation. In other words your lender has the right to take control of your home if you default on your loan.

Advantages of second mortgages include higher loan amounts lower interest rates and potential tax benefits. Rather it creates a. A new appraisal puts the value of the home at 525000.

Web Until last Friday Silicon Valley Bank was the 16th largest bank in the US worth more than 200bn Four decades ago Silicon Valley Bank SVB was born in the heart of a region known for its. So how much home equity can you tap. Web A second mortgage may be a good fit if youve gained equity in your home and have another big purchase to cover.

Web A sustained drop could push mortgage rates into the 5 range late in the second quarter or in the second half of 2023 but thats definitely not guaranteed Mortgage Bankers Association. 300000 x 085. Web What Is a Second Mortgage Exactly.

Like first mortgages second mortgages must be repaid over a specified term at a fixed or. Many people consider using their home equity to finance large financial needs but mortgage industry jargon has confused the meaning of certain terms including second mortgage home equity loan and home equity line of credit HELOC.

Second Mortgage Example A Simple Guide With Faqs

Getting A Second Charge Mortgage Comparethemarket

Second Mortgage What It Is And How It Works Forbes Advisor

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

8 Things To Know About Second Mortgages Marquee Funding Group

Mortgage Corp Productreview Com Au

Second Mortgage Information Rates Loans Lenders

How Much Of A Mortgage Goes Towards The Principal Amount Quora

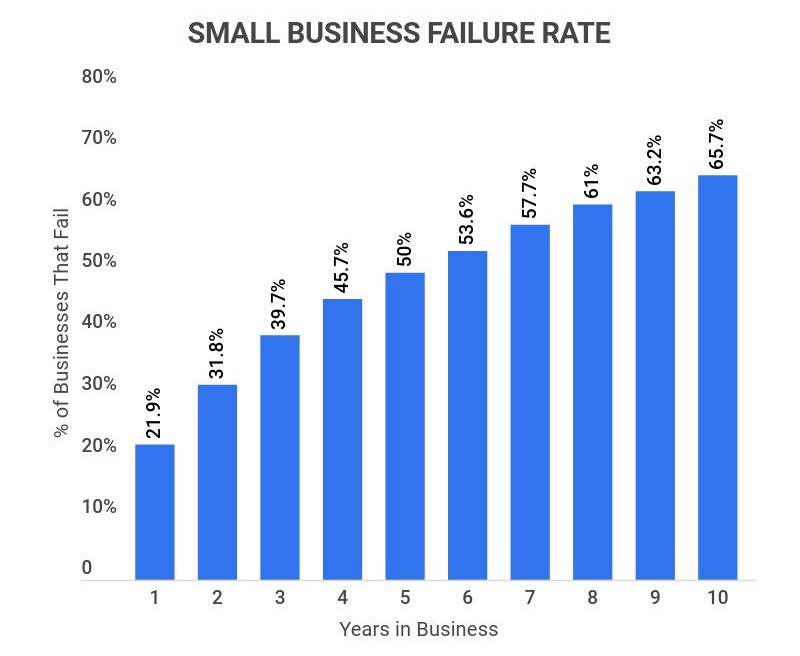

25 Essential Small Business Lending Statistics 2023 What Percentage Of Sba Loans Get Approved Zippia

25 Housing Market Predictions For The Next 5 Years 2023 2027

Home Loan Experts Page 6 Productreview Com Au

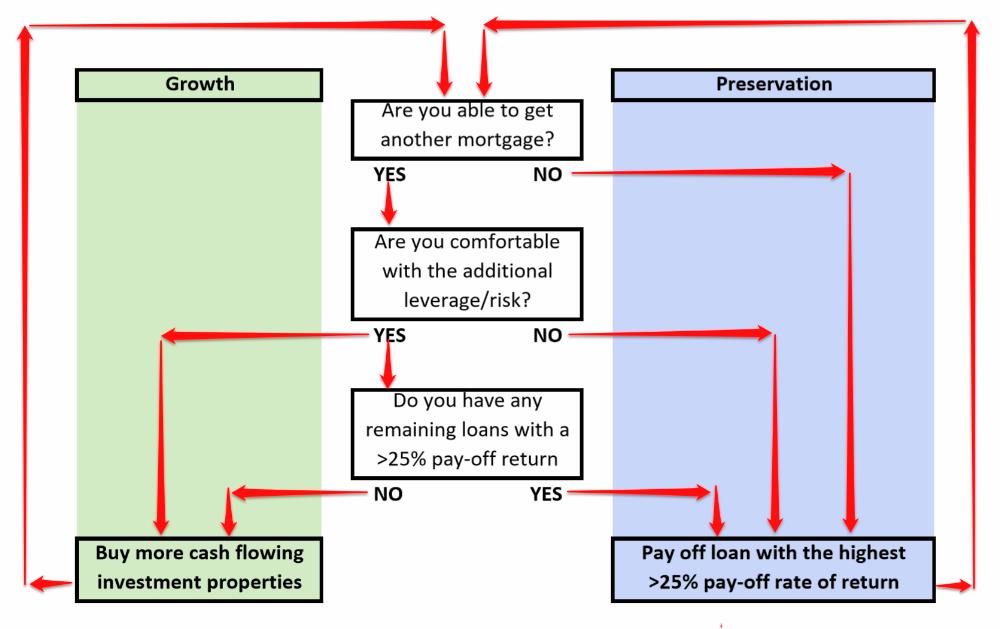

Should I Pay Down Or Pay Off My Mortgage Or Should I Buy More Investment Properties Oahu Real Estate Blog Outstanding Info

Second Mortgage Information Rates Loans Lenders

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Second Mortgages Explained The 80 20 Piggyback And More

Brian C Lykins On Linkedin Affording A Home Can Feel Like A Challenge For Some Homebuyers If You Are

Mortgage Pre Approval Burlington Oakville Hamilton Milton On